Outstanding claims – also known as outstanding debts – threaten the solvency of a company. The more unpaid customer accounts you have, the greater the liquidity problem. High rates of outstanding debts not only lead to significant interest losses, but if payments end up having to be compensated with loans, additional costs will be incurred. Companies therefore endeavor to collect outstanding payments for services rendered in a timely manner. This is usually done through an out of court dunning process, in which customers or business partners are informed of their default through a series of reminders. If out-of-court measures do not lead to the desired result, companies have the possibility of asserting claims for payment through a court order.

A past due invoice is a billing that has not been paid as of its due date. If a business extends credit to its customers, it is likely to experience situations where it must collect a past due invoice. It is essential to do so, since not receiving payments on time can cause major cash flow problems.

In this article, we will show you how to demand a settlement for outstanding bills in a professional manner. Correct procedure is of central importance during a dunning process. As a rule, the reminder letter is a prerequisite for further legal steps. In addition, judicial disputes can often be avoided by appearing commanding and stressing the importance of payment throughout the dunning procedure.

- Sometimes past due invoices are a result of a simple misunderstanding. Perhaps there was some ambiguity in the payment terms noted on the invoice. Or maybe the client had a problem with the product or service as delivered and is waiting for a remedy of some type before they will pay the invoice.

- Initial Payment Reminder: 7 Days Before the Due Date. Your first email should be friendly.

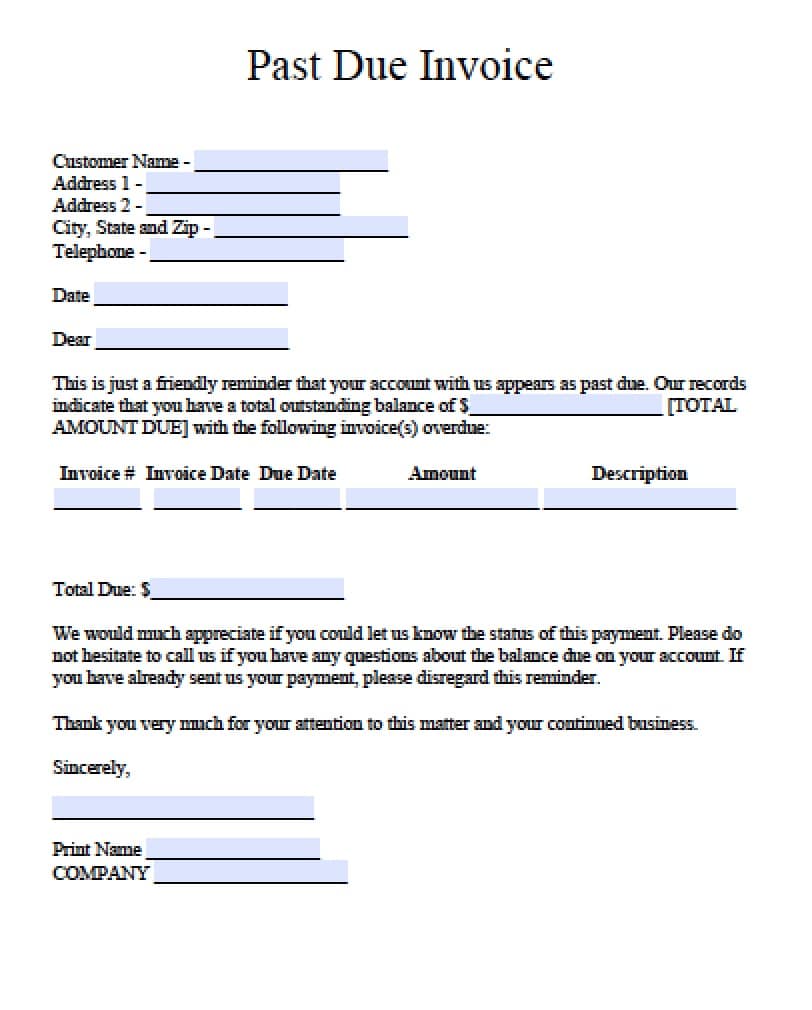

- A Past Due Invoice Letter Template is a document that is used to remind the debtor about his/her past due Invoice. This letter should show the total past due amount, the past due date, and the deadline. This letter also shows a breakdown of the invoices.

- Past due invoices are a serious drag on small businesses. According to the Export-Import Bank of the United States, a whopping 60% of world-wide invoices are paid late. And these late payments are negatively impacting cash flow in U.S.

- Successful past due letters: best practice

- Past due letters: templates for the first, second and third letters

United We Web

Get found. Grow online.

Businesses are uniting with IONOS for all the tools and support needed for online success.

Successful past due letters: best practice

The aim of the reminder letter as a tool for managing receivables is to reduce the number of outstanding debts, and to avoid the loss of receivables. At the same time, a professional dunning system is also geared towards retaining customers. This should be reflected in the tonality, as well as the number of escalation levels, which we will outline here to demonstrate business obligations to partners involved.

The legal basis for out-of-court past due notices by companies, lawyers, and credit bureaus are found in the Fair Credit Reporting Act (FCRA) and the Fair Credit Billing Act (FCBA). The Federal Trade Commission (FTC) oversees the implementation of these regulations. Court order for payment is regulated differently depending on what state you are in – disputes are usually settled at state level through general jurisdiction state and county courts. However, federal district and regional courts retain exclusive jurisdiction over cases considered to be an aspect of federal law or when the issue concerns parties located in different states.

Central legal concepts within the framework of the dunning system are maturity and default.

Maturity

The prerequisite for a dunning procedure is a creditor/debtor relationship, pursuant to state or federal laws, which allow a creditor to demand payment from his debtor for goods or services rendered. This type of debt relationship usually comes about through a contract (e.g. a purchase agreement). The following applies in principle: Missed payments can only be claimed through the dunning system if a claim exists and it can be proven that the claim is due:

Max Musterman wants to pave his driveway, so he buys a ton of gravel and three pallets from the hardware store. A payment term of two weeks after the delivery date is set out in the purchase agreement. The DIY store delivers the supplies the next day, thus fulfilling their contractual obligation, and they now have the right to reimbursement of the purchase price. This results in a debt relationship between Max Musterman as a debtor, and the hardware store as a creditor.

If the debtor fails to provide the contractually agreed upon service until the due date (e.g. 14 days after delivery), then the creditor has the right to demand it.

The term ‘maturity' refers to the point in time when a creditor is entitled to demand an outstanding payment from his debtor. The immediacy of the debtor's obligation to provide payment is linked to the due date.

In the above example, the debtor automatically falls into arrears once the due date has arrived. Reaching this point is a prerequisite for a creditor to assert claims against the debtor on the basis of due payment.

Default

If a debtor is in default of payment, the creditor has a claim for damages (in the form of dunning charges) and interest. A prerequisite for this are circumstances which may cause delay. This is the case with non-payment, despite the due date and the reminder.

The past due reminder letter is used as a tool for debt management purposes to give debtors an extension.

In the above example, the debtor Max Musterman automatically falls into arrears because the terms of payment are specifically stated with a calendar date (14 days after delivery). It is not necessary for the hardware store to issue an additional reminder, as Max Musterman already has the time information in his purchasing agreement, however, it is best practise to issue a past due notification letter the day after the due date, 60 days past due date and 90 days past due date.

The legal timeframe within an invoice is required to be paid at the discretion of the contract between the debtor and the creditor. Should the debtor fail to pay by the specific date set out in the contract, the creditor may then begin the dunning procedure either themselves, or through a debt collection agency.

Past due letter: specifications

There is no federal law or legal requirement from the US federal government, or outlined in the Fair Debt Collection Act, that defines exactly how a legal reminder, or past due letter should be formulated. In fact, the debt collector can also contact the person in written form, verbally, or through conclusive behavior. However, the United States Code does reference the information a creditor must provide in their communication with the debtor:

Past due letters must contain the following:

- The amount of the debt.

- The name of the creditor to whom the debt is owed.

- A statement that if the consumer notifies the debt collector in writing within the thirty-day period that the debt, or any portion thereof is disputed, the debt collector will obtain verification of the debt of a copy of a judgement against the consumer and a copy of such verification or judgement will be mailed to the consumer by the debt collector.

- A statement that, upon the consumer's written request within the third-day period, the debt collector will provide the consumer with the name and address of the original creditor, if different from the current creditor.

Due to its strong character, the past due letter is the most popular form of correspondence.

If a debtor denies having received the reminder, the burden of proof lies with the creditor. It is therefore always recommended to use the written form. In addition, it should be demonstrated that the debtor has received the warning. This can be done by commissioning a messenger to provide witness proof. In the case of an entry letter, the postal deliverer acts as a witness. Thus, absolute legal certainty can be provided by the bailiff.

The following then applies: A past due letter must be explicitly titled as such. Accordingly, even a particularly polite or humorous demand for payment fulfills the function of the reminder, provided it satisfies the above requirements. A polite professional tone is always recommended, as you do not want to tarnish your own reputation as a business through impolite or rude correspondence.

A copy of the invoice may be enclosed with a reminder. In practice, open invoices are sometimes listed directly in the letter of formal notice. This is particularly advisable if there is the possibility that the debtor has misplaced the invoice, or possibly never received it. A reminder of the payment terms and even a threat of legal consequences may be required to increase pressure on the debtors.

Dunning procedure

In the USA, it is standard practice to send three reminders (past due letters) in commercial debt cases. There are slight differences between the first, second, and third letters. Generally, this dunning procedure is applied even if the debtor has already fallen into arrears, and could technically be brought to court immediately. The reason for this is customer retention.

Avoid sending more than three past due letters, as you may risk your concerns not being taken seriously since no further consequences seem to be feared by the debtor.

It is not always the case that outstanding payments are due to the unwillingness of the debtor to pay. In some cases, recipients have forgotten about the debt and settle the outstanding amounts. In other cases, the invoice may not have been received by the recipient of the invoice. In order to avoid unnecessary annoyance by defaulting clients, it is advisable to first remind them of their obligation to pay.

You may refer to the IONOS templates when creating reminders and due payment letters.

Past due letters: templates for the first, second and third letters

Use professional past due letter templates when dealing with defaulting clients. IONOS provides a pre-formulated sample letter for the first, second and third reminders as a Word file, or in Excel format.

Templates for the first past due letter/payment reminder

The first reminder should be made immediately if you find that an invoice amount has not been paid despite the due date having passed. If you have no reason to doubt that the debtor will pay his debt, or if you have no knowledge of bad credit from this debtor, then the first reminder should be written in polite terms. Express in a friendly, yet unequivocal manner, that you demand the due payment.

Here is a sample of what the body of the letter could look like:

Depending on the severity of the delay and the debt incurred, stronger language may be recommended when wording your letter before action.

Second past due letter: Template for the second reminder

If the invoice is still not settled after 30 days of receiving your first reminder, it is advisable to send the debtor a second warning letter. This is usually explicitly titled with ‘reminder' and written in a more serious, unmistakable tone. It is also advisable to provide another type of payment plan in the second warning letter:

Third past due letter: template for the last reminder

If a debtor remains inactive despite two reminders, send the third and last reminder. In this, highlight again the open invoice amount and establish a final payment date. Additionally, you should state in the third reminder that if you do not pay by the payment date, further legal actions will be taken to assert your claims. This pay include the involvement of a lawyer or the transfer of a claim to a collection office.

Avoid numbering the reminder letters, as a payment reminder titled with ‘1st' will give the impression that you are quite willing to disclose further reminders. This could lead defaulting debtors to await the receipt of further letters before the invoice is settled.

How to use the past due templates from IONOS

With the IONOS templates, you can create professional payment reminders for the usual three step escalation. Proceed as follows:

- Download the template: All templates are available as Word or Excel files.

a. File format: Select the appropriate template in the desired file format.

b. Download: Click on the download link below the thumbnail for the template. - Replace all placeholders with individual data: All the templates contain text (e.g. address fields) that act as placeholders. These samples statements are designed to help you understand the use of the template and ensure that your reminder contains all the important information. Go through the document field-for-field and replace the placeholders in the following friends with individual data.

a. Header text: Each past due letter template contains a header area. This contains, in addition to the name of your company, the address of the customer to be advertised, as well as your sender's address. Replace the placeholders with your individual details.

b. Date: Make sure that your reminder is marked with the current date.

c. Invoice number: Replace the sample invoice number with the number of the invoice to which your reminder refers.

d. Invoice date: Replace the sample date with the date of the invoice that was not paid.

e. Customer number: Enter under ‘Customer No.' the number of the defaulting customer.

f. Reminder text: Depending on the template, the pre-formulated dunning texts contain data and accounting amounts. Instead, insert your individual details.

g. Invoice: The third reminder contains an invoice in which the open invoice amount is added up with the default interest and the dunning costs incurred up to that point. Transfer your individual details and determine the total amount due.

h. Greetings: Replace the greetings form with the preferred phrase. It is recommended to repeat the name of the signer in type-written form.

i. Footnote: The footnote of a formal notice letter should include the complete address of your company, your VAT identification number, and the bank details to which the payment should be made (or details on any alternative payment methods you may wish to offer). Make sure that you completely overwrite the template's placeholders with your individual data. - Save and print the template: Print out and send the template to the defaulting customer. Always keep a copy of the reminder for your records. This can be done electronically by storing the Word or Excel document in a designated file folder on your system. Alternatively, print out another copy and keep the paper copy in your record books.

Unsuccessful past due letter: what now?

If the out-of-court dunning procedure does not lead to the desired result, a creditor can obtain legal assistance by taking the case to the small claims court (if the amount is under the state limit), obtaining legal services about how to proceed if the sum is above the state limit, or selling the debt on to a debt collection agency. Blue card rust airfield.

Related articlesIn a perfect world, you'd be paid on time, every time—but unless you have a point of sale business model, you're probably all too familiar with chasing payments from clients. It's a chore, but sending payment reminder emails to clients is an important way to help keep your cash flow healthy.

If you cringe at sending payment reminder emails and letters, you're not alone. A lot of business owners feel uncomfortable asking directly for payment. But remember that it's really a professional courtesy to send them, as long as they're worded nicely and sent promptly. In addition to helping remind clients that they have outstanding invoices, payment reminders can help you clear up any invoicing errors or payment issues, and warn clients about upcoming measures like late fees or collections. Having a system for sending them is the first step in making it a habit!

Timing your emails is key

The best payment reminder emails are both effectively worded and effectively timed. Ideally, you should structure your reminder schedule around the payment terms in your contract. It's a good idea to send a payment reminder shortly before the due date of the invoice, one shortly after, and then regularly after that. But how soon before the due date you'll send them (and how often to follow up) will depend on your payment terms.

Payment terms: a brief overview

Payment terms spell out when and how you and your client agree you should be paid, and what happens if you aren't. They should be included in the contract your client signs at the beginning of your work together, so they're enforcable later. Here are a few main points to consider:

- How long of a window will you give? Your invoice should include the window of time a customer has to pay you—terms like Net 30 and Net 15 are good shorthand, but it's nice to spell it out in plain language, like 'Payment is due 15 days after receipt of this invoice'

- Will you offer an early payment discount or impose late fees? Either way, you'll need these in the contract before you begin work. Early payment discounts are nice if you can afford them, but late fees help you recover some of the cost of the extra time you spend chasing unpaid invoices. Make sure to do a little research on the law in your area as there are often legal restrictions on what late penalties you can impose.

- When will youescalate and how? You may decide to work with a third party collection agency or get legal help if the outstanding amount is significant and you've been waiting a long time for it. This should be a last resort, after you've exhausted all other options.

Having payment terms will also help keep your communications professional. When you have real consequences you can enforce, it will prevent you from feeling powerless over your clients' willingness (or unwillingness) to pay you.

General info to include in your payment reminder email

Clients sometimes need payment details for their own records. If you include all of the relevant information in your payment reminder email, you'll minimize the chances that your client will have to ask you for it.

In the subject line, include your business name and the invoice number. A good example might be 'Payment reminder: [business name] [invoice ####].' That way, your client can see exactly what invoice is outstanding from the subject line alone, which is especially helpful if you email them multiple invoices. See also what information to include from you invoice template configuration.

In the body of the email, include:

- a copy of the invoice

- due date of the invoice and amount owing

- a link to payment

- accounts receivable statement of all outstanding invoices for that client, if applicable

- reminder of any payment terms coming into effect, such as late fees

Also make sure you have all your contact information in your email signature, so they can get ahold of you another way if they need to.

4 payment reminder email samples to clients for due or over due invoices

It's a good idea to vary the wording of your email depending on when you're sending it. A payment reminder email sent before an invoice is due will be much different than a payment reminder letter sent six months after the due date.

Remember that no matter how long it's been, calm professionalism is key. Clients are much more communicative when they can count on you not to be hostile, which is important if they need to negotiate a payment plan or extended due date. While you should be careful with how much you're willing to compromise, it's occasionally a good idea to do so to maintain your professional relationship. Below are a few different scenarios to consider, and how to word your payment reminders for the best results.

Friendly email reminder #1: before the invoice is due

Sending a gentle reminder email to your client for payment a few days before the invoice is due will help remind those clients who just got busy and forgot. For clients who prefer snail mail, this can also double as a template for a friendly payment reminder letter. If you offer an early payment discount, consider including an additional reminder about when their early payment discount expires.

Subject line: Payment reminder: [business name] [invoice ####]

Text:

Hello [client name],

Just a friendly reminder that [invoice ####] is due on [due date]. The balance due is [amount outstanding]. You can view your invoice here: [link to invoice].

[Optional: There are still X days left to take advantage of your early payment discount!]

Please feel free to contact us if you have any questions or concerns.

Regards,

[your name]

Polite email reminder #2: shortly after the invoice is due

This email should come a few days after the invoice was due, to nudge clients who still haven't paid you yet. If you have a late fee, you can send a modified invoice. You could also let them know if you're giving a short grace period and, if so, when the late fee will take effect.

Subject line: Payment reminder: past due [invoice ####] for [business name]

Text:

Hello [client name],

I'm contacting you to check in on overdue [invoice ####], which was due on [due date]. The balance due is [amount past due]. You can view your invoice here: [link to invoice].

[Optional: We are extending you a grace period of three days, after which we will apply a late fee of X%]

Please let us know when we can expect payment, or if there are any issues we can help resolve.

Regards,

[your name]

Strong email overdue reminder #3: client has multiple overdue invoices

You may have encountered this scenerio if you have larger corporate clients that you invoice frequently. In these situations, it's best to give your client a list of their accounts receivable and consider if you have the flexibility to negotiate payment terms. This is particularly likely if you're sending weekly invoices, but your client has a monthly cheque issue schedule. Here's an example of a reminder with more formal language for this scenario:

Subject line: Payment reminder: past due invoice [invoice numbers] for [business name]

Text:

Hello [client name],

Past Due Invoice Email

Please be advised that [invoices ####, ####, ####] are currently past due. Your total amount owing is [amount outstanding]. I've attached a summary of your accounts receivable for your review. You can view your invoices here: [link to invoices].

Please remit payment as soon as possible. We appreciate your prompt attention to this matter.

Regards,

[your name]

Past Due Invoices Friendly Reminder

Payment reminder #4: invoices long overdue

Retroarch ps3 games. If your client hasn't paid you back after a number of months, you'll need to decide how to escalate the situation. This may depend on the client, but it's a good idea to have a default rule for when and how you'll do it. It might include stopping work with clients you invoice regularly, taking their debt to a professional collection agency, or getting legal advice if it's a significant amount.

It's worth noting that you should also attempt to contact your client by phone and mail before taking any drastic measures. A payment reminder letter with the attached text, in addition to the email, underscores the seriousness of your message—you can use this text as a sample letter as well. This email needs to be more firm in tone:

Please be advised that [invoices ####, ####, ####] are currently past due. Your total amount owing is [amount outstanding]. I've attached a summary of your accounts receivable for your review. You can view your invoices here: [link to invoices].

Please remit payment as soon as possible. We appreciate your prompt attention to this matter.

Regards,

[your name]

Past Due Invoices Friendly Reminder

Payment reminder #4: invoices long overdue

Retroarch ps3 games. If your client hasn't paid you back after a number of months, you'll need to decide how to escalate the situation. This may depend on the client, but it's a good idea to have a default rule for when and how you'll do it. It might include stopping work with clients you invoice regularly, taking their debt to a professional collection agency, or getting legal advice if it's a significant amount.

It's worth noting that you should also attempt to contact your client by phone and mail before taking any drastic measures. A payment reminder letter with the attached text, in addition to the email, underscores the seriousness of your message—you can use this text as a sample letter as well. This email needs to be more firm in tone:

Subject line: Urgent: past due invoice [invoice #### for [business name]

Text:

Hello [client name],

Our records show that [invoice ####] is now [number of days overdue]. Download tor browser for chromebook. We are writing to request urgent payment for the the total outstanding balance of [amount past due]. You can view your invoice here: [link to invoice].

At this point, we will need to escalate the issue further if we don't hear from you in the next few days. Please contact us as soon as possible to arrange payment.

Regards,

[your name]

Thank you email for payment received

You should always send a thank you email after your client pays an invoice, regardless of whether or not it was paid on time. This serves not only as an important way of maintaining rapport with your clients, but also is an additional record of your having received their payment.

Subject line: Payment confirmation for [business name] invoice [invoice ####]

Text:

Hello [client name],

Thank you for your payment of [business name] [invoice ####]. We appreciate your business and look forward to working with you in the future!

Regards,

[your name]

A few additional tips

Past Due Invoice Message

- Tracking and recording

Remember that it's important to update your accounts receivable records once you get paid. There's nothing more embarassing than sending a payment reminder for an invoice that your client has been paid for! - Automating your payment reminders

One solution to this is sending automatic payment reminders with software like vcita. That way, you'll only need to decide the reminder schedule, and the legwork of sending them out will be done for you. Invoicing software makes it easy to attach a link to your online payment portal right from the email, so your client doesn't have to hunt up any payment information. Once your client's invoice is paid, the software will update your records automatically.

Payment reminders aren't just an administrative task; they'll help your business stay afloat! If you invest a little time in organizing them, you'll see a huge return on that investment in better cash flow and smoother client relationships.